The Impact of Cryptocurrency on Global Finance and Beyond

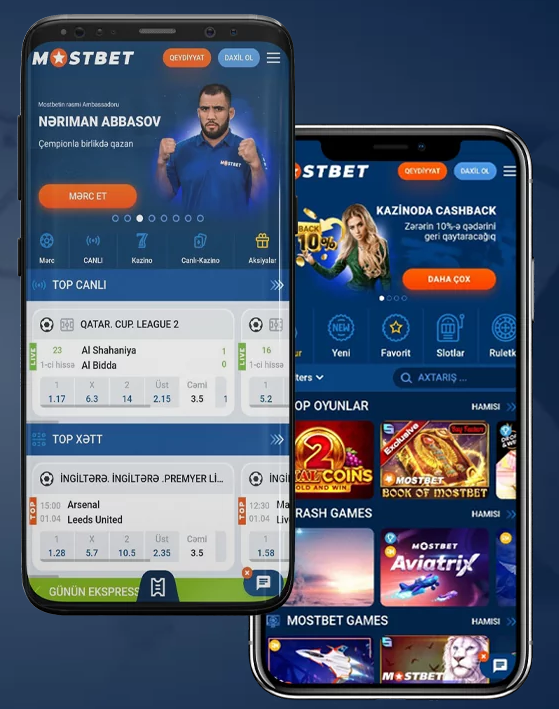

Cryptocurrency has emerged as a formidable force in the global financial landscape, radically altering how we think about money, transactions, and investment. Its influence extends beyond mere financial transactions and has permeated various sectors, revolutionizing both technology and societal interactions. As a digital currency that relies on cryptography for security and operates on decentralized networks such as blockchain, its allure stems from both its investment potential and its promise of democratizing access to financial systems. In this article, we will explore the multifaceted impact of cryptocurrency on various domains, from finance to technology, and its future implications. For those interested in alternative investment platforms, check out The Impact of Cryptocurrency on Online Casinos in Bangladesh Mostbet bd.

1. Revolutionizing Traditional Finance

The traditional financial system is often characterized by intermediaries, such as banks and financial institutions, which facilitate transactions and manage assets. Cryptocurrency introduces a paradigm shift by enabling peer-to-peer transactions without the need for intermediaries. This has profound implications for various aspects of finance, such as remittances, lending, and investment. For instance, low-cost cross-border payments have become feasible through cryptocurrencies, allowing individuals in developing countries to send and receive funds with minimal fees.

Additionally, decentralized finance (DeFi) protocols have gained traction, offering services such as lending, borrowing, and trading without traditional banks. Users can lend their assets to others and earn interest directly, circumventing the constraints and costs associated with conventional banking. This shift empowers individuals by providing them with greater control over their financial assets and fostering financial inclusion, especially for the unbanked population.

2. Investment Opportunities and Risks

The rise of cryptocurrencies has created a new realm of investment opportunities. Bitcoin, Ethereum, and an array of altcoins have attracted millions of investors seeking high returns in a relatively short period. Crypto markets are often highly volatile, presenting both immense risks and opportunities for gains. Investors can diversify their portfolios by including cryptocurrencies alongside traditional assets like stocks and bonds, potentially enhancing overall returns.

However, this volatility also raises significant concerns. The lack of regulation and consumer protections means that investors can lose substantial sums overnight. Additionally, the proliferation of Initial Coin Offerings (ICOs) and tokens has led to instances of fraud and scams, putting inexperienced investors at risk. Therefore, while the potential for wealth generation in the cryptocurrency space is enticing, it necessitates a cautious and informed approach to investing.

3. Technological Innovations and Blockchain

At the heart of cryptocurrency’s impact is blockchain technology, which serves as a transparent and secure ledger of transactions. This technology is not just limited to digital currencies; it offers a diverse range of applications across industries. For instance, supply chain management can benefit from blockchain by providing transparency and traceability, allowing businesses to track products from origin to consumer.

Furthermore, industries such as healthcare, real estate, and insurance are exploring blockchain solutions to enhance data security, streamline processes, and reduce fraud. Smart contracts, self-executing contracts with programmed conditions, are revolutionizing various industries by automating agreements and negating the need for intermediaries, thus driving efficiency.

4. Societal Implications of Cryptocurrency

Beyond finance and technology, the rise of cryptocurrency has profound societal implications. The democratization of finance fosters inclusivity, ensuring that individuals previously marginalized by traditional banking systems can access financial services. Furthermore, cryptocurrencies can provide a safe haven during times of economic instability, as seen in countries experiencing hyperinflation or political turmoil.

However, the anonymity offered by cryptocurrencies also raises ethical concerns. Criminal activities, including money laundering and drug trafficking, can exploit the untraceable nature of many digital currencies. As a result, regulators are grappling with how to strike a balance between encouraging innovation and preventing illicit activities.

5. Regulatory Landscape and Future Outlook

As cryptocurrency continues to gain prominence, the regulatory landscape is evolving. Governments worldwide are recognizing the need for frameworks to protect consumers while fostering innovation. Some countries have embraced cryptocurrencies, considering them as legitimate forms of payment, while others have imposed bans or strict regulations.

The future of cryptocurrency is likely to involve more comprehensive regulation, enhancing consumer protections and addressing issues related to security and fraud. The convergence of traditional financial institutions and cryptocurrencies is already taking shape, with many banks exploring their own digital currencies and integrating blockchain technology into their operations.

Conclusion

The impact of cryptocurrency on global finance and society is undeniable. Its potential to democratize access to financial services, coupled with the innovative capabilities of blockchain technology, suggests that cryptocurrencies will play an increasingly significant role in the future economic landscape. However, as we navigate this rapidly evolving space, it is crucial for stakeholders—including regulators, businesses, and consumers—to work collaboratively to harness the benefits of cryptocurrencies while mitigating associated risks. Ultimately, the trajectory of cryptocurrency will depend on the collective ability to balance innovation with regulation, ensuring a sustainable and equitable financial ecosystem for all.